My renovation project was subdivided and manufactured over $240K in equity in 9 months

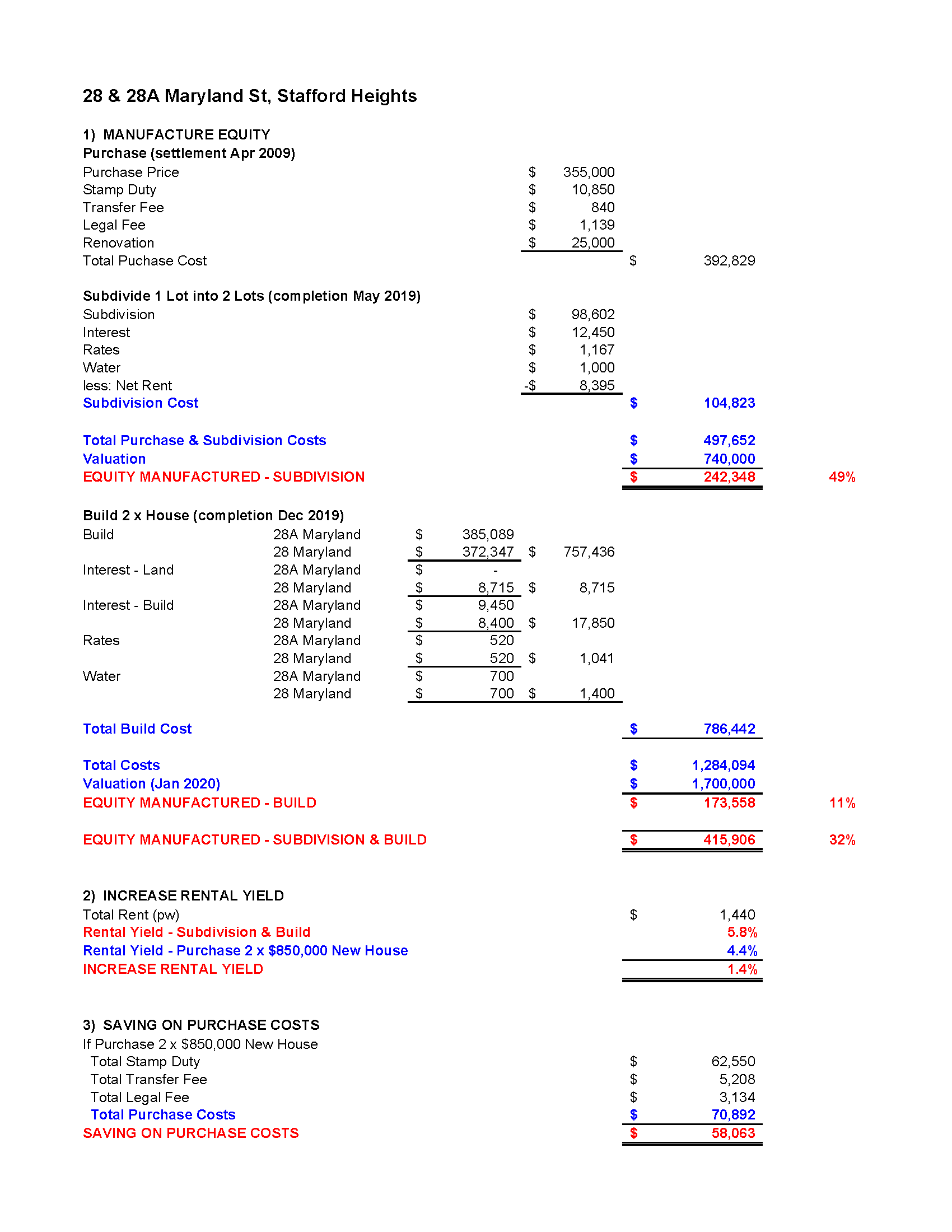

In Mar 2009, i.e. in the midst of the global financial crisis (GFC), I came across this 1960's highset brick veneer house on 660 sqm that required a lot of works. It was a deceased estate and the previous offer had just fallen over. As we were in a multiple offer situation, I made a cash and unconditional offer and was subsequently accepted by the vendor. I had a renovation project, which I spent $25,000 plus my labour.

Fast forward 5 years, the Brisbane City Plan 2014, which commences on 30 Jun 2014, allows properties that are 600 sqm or larger and within 200 m walking distance to a minimum 2,000 sqm Neighbourhood Centre, to be subdivided. I hit the jackpot!

My strategy to manufacture equity is to subdivide 1 lot into 2 lots, build a house on each lot, and keep them long term. New or newish houses are in much higher demand than older-styled houses in the same area. Buyers will pay a premium to buy and tenants will pay a premium to rent the new or newish houses. If I were to play developer and sell the subdivided land or new houses, I would lose the opportunity to good assets that I created to appreciate in value and rent over time.

The subdivision project went relatively smoothly. The 2 vacant blocks were valued at $370,000 each in May 2019. Hence I manufactured $242,348 or 49% in equity in 9 months and I still had a full time job! In an ideal world, I would go back to the bank to refinance the house and uplifted $193,000 in equity, which would be used to fund the build project. However the APRA's responsible lending guidelines stop me from doing that.

In fact I had started the build project 3 months before the subdivision was completed. To ensure a successful build project, you have to build the right house for the block and area, i.e. not to over or under capitalise on the land.

There is no perfect block to build on. 28 Maryland St had a very steep left rear corner. The backyard would be unusable if I did nothing. Eventually we exported 35 truckloads dirt from the site and installed retaining walls, costing a total of $70,000. However once the new house are built, it is a beautiful home. No one will talk about its unusable backyard anymore. Essentially I eliminated the shortcoming of the block by build a new house on it.

The construction of the 2 houses went relatively smoothly until the building certifier's final inspection. Their reports required the builder to fix a few items, which were no dramas, and need the owner (me) to install privacy screens to a total of 9 windows amongst both houses. Not backing down, I reviewed the building approvals again and confirmed that there was no mention of privacy screens being required. Hence I escalated the matter to the building certifier's manager and challenged the final inspection reports. Eventually they removed the privacy screen requirement from the final inspection report and issued the building completion certificate. It would have been a costly exercise in term of time and money should I not challenge the final inspection reports. I dodged a bullet!

Apart from that, the build project went according to plan. The 2 new houses was valued at $850,000 each in Jan 2020. Hence I manufactured $173,558 or 11% in equity.

The successful subdivision and build projects also increased the rental yield by 1.4%, i.e. I achieved a higher 5.8% rental yield compared to 4.4% if I were to buy 2 new houses at $850,000. In addition, I had a $58,063 saving in purchase costs.

Having said that, the PRIZE for subdivision and build projects is EQUITY MANUNFACTURED, which enables you to buy your next property or do the next project, create wealth and take steps closer to your financial freedom.

- EQUITY MANUFACTURED - SUBDIVISION

- $242,348 (49%)

- EQUITY MANUFACTURED - BUILD

- $173,558 (11%)

- EQUITY MANUFACTURED - SUBDIVISION & BUILD

- $415,906 (32%)

- INCREASE RENTAL YIELD

- 1.4% (to 5.8%)

- SAVING ON PURCHASE COSTS

- $58,063

Total Project Economics

Get your FREE 15-minute strategy session now

Why be a passive property investor (buy, pray and hold strategy) when you become an active property investor (buy, manufacture equity, uplift equity and hold strategy)? Let me show you my proven strategies to turbo boost your property portfolio, create wealth and take steps towards your financial freedom.

Book your strategy session