Knowing the city plan in detail allowed me to buy this property without paying a premium for its subdivision potential

The Brisbane City Plan 2014, which commences on 30 Jun 2014, allows properties that are 600 sqm or larger and within 200 m walking distance to a minimum 2,000 sqm Neighbourhood Centre, to be subdivided. When 39 Maryland St, which was on 597 sqm block, came onto the market in Dec 2014, not many people including vendor and agent know that the property can be subdivided. Hence I seized the opportunity and bought this 1990's single storey brick veneer house without paying a premium for its development potential.

My strategy to manufacture equity is to subdivide 1 lot into 2 lots, build a house on each lot, and keep them long term. New or newish houses are in much higher demand than older-styled houses in the same area. Buyers will pay a premium to buy and tenants will pay a premium to rent the new or newish houses. If I were to play developer and sell the subdivided land or new houses, I would lose the opportunity to hold assets that I created to appreciate in value and rent over time.

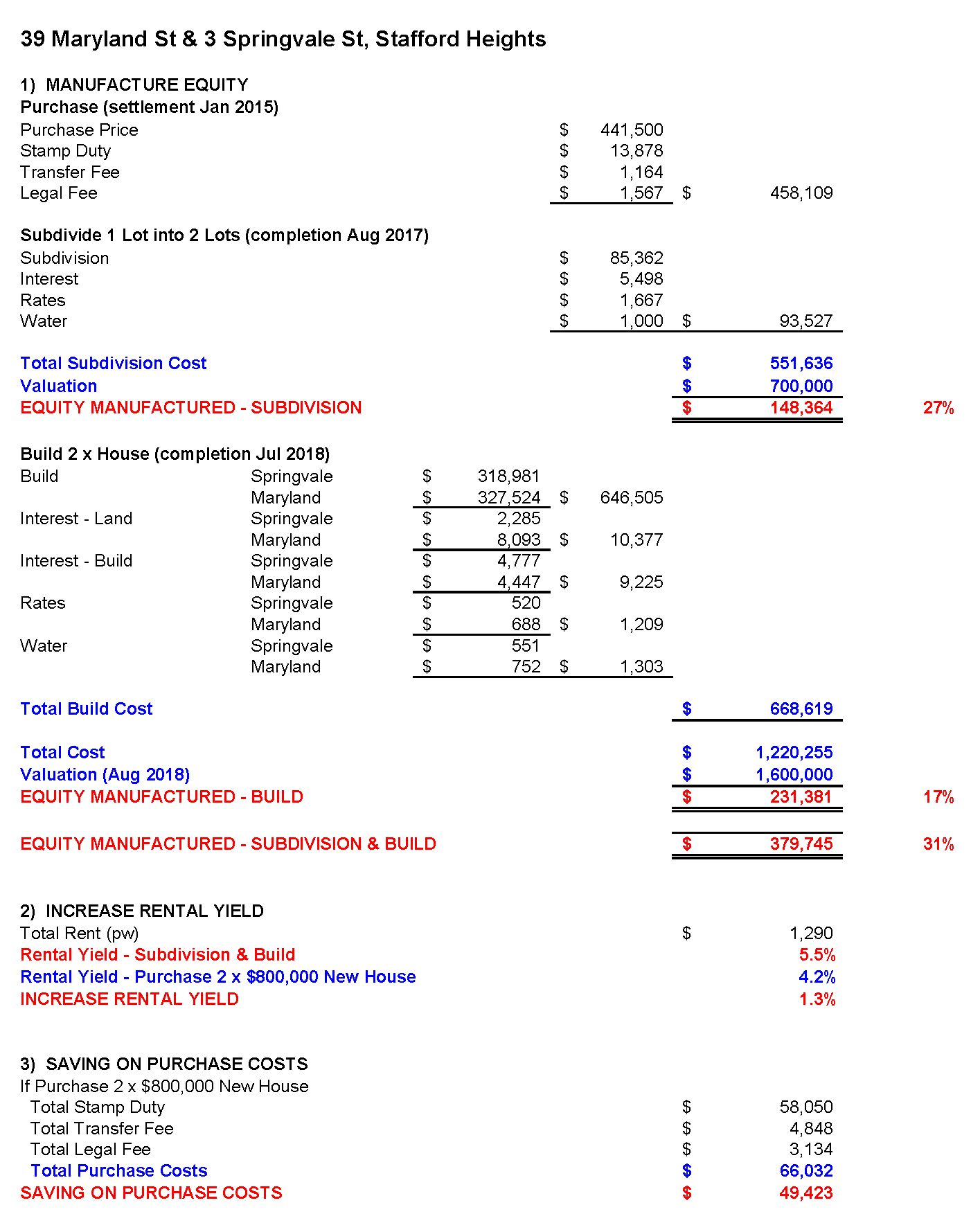

The subdivision project went relatively smoothly. The 2 vacant blocks were valued at $350,000 each in Jul 2018. Hence I manufactured $148,364 or 27% in equity in 9 months and I still had a full time job! I refinanced the 2 vacant lots and uplifted $120,000 in equity, which was used to fund the next project, i.e. build 2 houses.

In fact I had started the build project 3 months before the subdivision was completed. To ensure a successful build project, you have to build the right house for the block and area, i.e. not to over or under capitalise on the land.

There is no perfect block to build on. 39 Maryland St is an odd shaped block and the 3 Springvale St is block that is not deep enough. However once the new house is built, it is a beautiful home. No one will talk about it being odd shaped or not deep enough. Essentially I eliminated the shortcomings of the block by build a new house on it.

Two months after the build project commenced in 39 Maryland St, the construction had to stop due to the footing on the rear left corner of the house would be too closed to the stormwater pit, which was installed during the subdivision phase. That resulted in a 9 weeks delay.

Apart from that, the build project went according to plan. The 2 new houses was valued at $800,000 each in Aug 2018. Hence I manufactured $231,381 or 17% in equity. Again I went back to the bank to refinance both houses and uplifted $185,000 in equity, which was used to fund my next purchase or project.

The successful subdivision and build projects also increased the rental yield by 1.3%, i.e. I achieved a higher 5.5% rental yield compared to 4.2% if I were to buy 2 new houses at $800,000. In addition, I had a $49,423 saving in purchase costs.

Having said that, the PRIZE for subdivision and build projects is EQUITY MANUNFACTURED, which enables you to buy your next property or do the next project, create wealth and take steps closer to your financial freedom.

- EQUITY MANUFACTURED - SUBDIVISION

- $148,364 (27%)

- EQUITY MANUFACTURED - BUILD

- $231,381 (17%)

- EQUITY MANUFACTURED - SUBDIVISION & BUILD

- $379,745 (31%)

- INCREASE RENTAL YIELD

- 1.3% (to 5.5%)

- SAVING ON PURCHASE COSTS

- $49,423

Total Project Economics

Get your FREE 15-minute strategy session now

Why be a passive property investor (buy, pray and hold strategy) when you become an active property investor (buy, manufacture equity, uplift equity and hold strategy)? Let me show you my proven strategies to turbo boost your property portfolio, create wealth and take steps towards your financial freedom.

Book your strategy session