How I knew the price was right with a detailed feasibility analysis

I came across this 405 sqm block, which already been subdivided, in beautiful pocket of Camp Hill in Jan 2014. Upon making an offer for $441,000, I had buyer's remorse and questioned myself if I had paid too much, although my due diligence and feasibility analysis gave a thumbs up for the build project. I would never imagine myself paying over $400,000 for a block of land in Camp Hill then.

Thank goodness I listened to my due diligence and feasibility analysis, and proceeded with the purchase, which was proven to be the right decision. Fast forward 10 years to 2024, a similar block is worth over $1,000,000.

My strategy to manufacture equity is to build a house on the lot, and keep them long term. New or newish houses are in much higher demand than older-styled houses in the same area. Buyers will pay a premium to buy and tenants will pay a premium to rent the new or newish houses. If I were to play developer and sell the new house, I would lose the opportunity to good asset that I created to appreciate in value and rent over time.

To ensure a successful build project, you have to build the right house for the block and area, i.e. not to over or under capitalise on the land.

There is no perfect block to build on. 56 Tranters Av has a 2.75 m fall from the front boundary to rear boundary. However once the new house is built, it is a beautiful home. No one will talk about the 2.75 m fall. Essentially I eliminated the shortcoming of the block by build a new house on it.

Speaking as an experience project manager who has built 11 houses, there will be regrets for any build projects. Most importantly is that we learn from these regrets and get better in the future projects.

For 56 Tranters Av, in hindsight, I would redesign the media room to have a window and improve on the electrical plan such as adding ceiling fans throughout and pendant lights on the kitchen island bench.

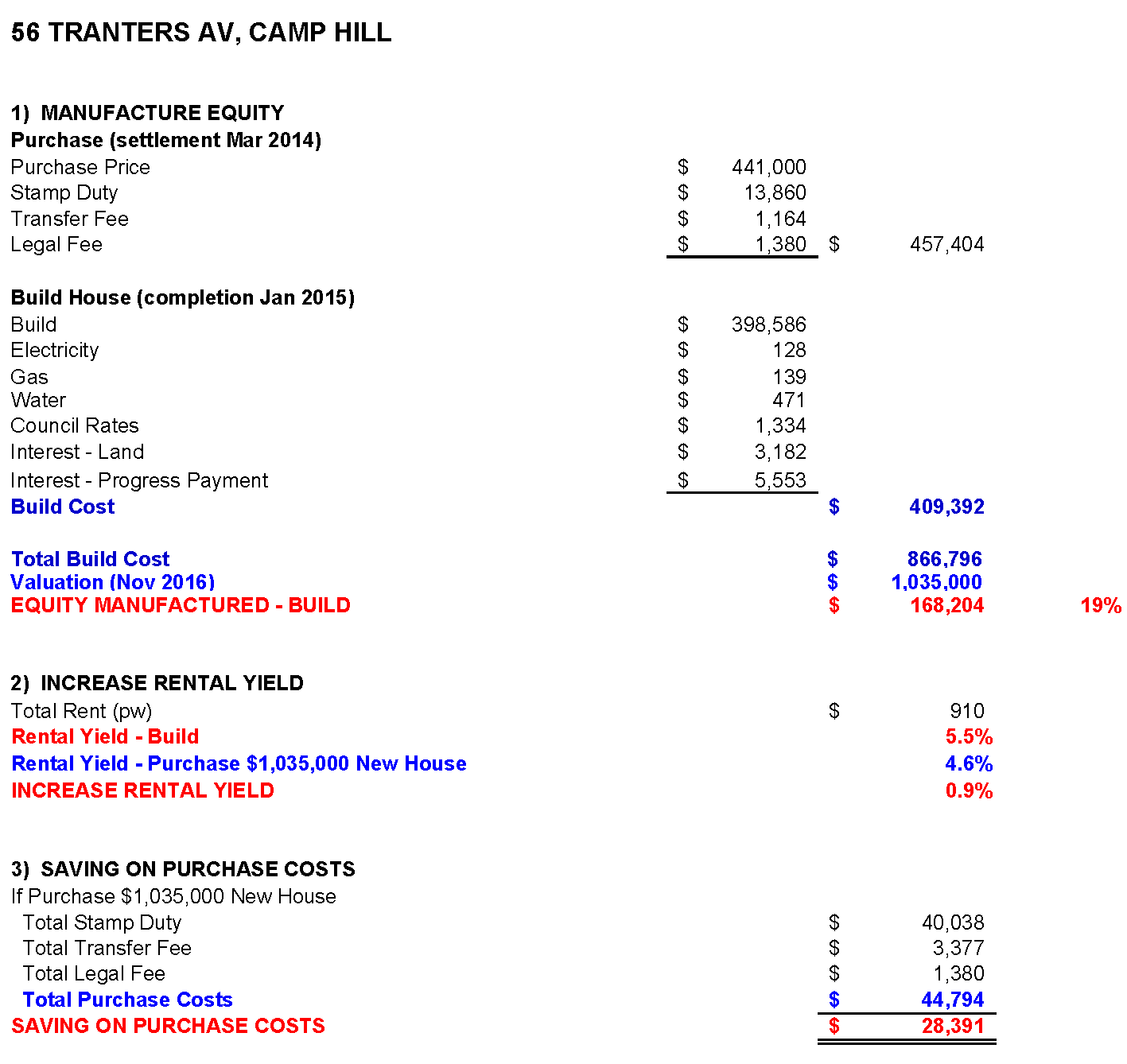

Apart from these regrets, the build project went according to plan. The new house was valued at $1,035,000 in Nov 2016. Hence I manufactured $168,204 or 19% in equity. I went back to the bank to refinance the new house and uplifted $134,000 in equity, which was used to fund my next purchase or project.

The successful build project also increased the rental yield by 0.9%%, i.e. I achieved a higher 5.5% rental yield compared to 4.6% if I were to buy a new house at $1,035,000. In addition, I had a $28,391 saving in purchase costs.

Having said that, the PRIZE for the build project is EQUITY MANUNFACTURED, which enables you to buy your next property or do the next project, create wealth and take steps closer to your financial freedom.

- EQUITY MANUFACTURED - BUILD

- $168,204 (19%)

- INCREASE RENTAL YIELD

- 0.9% (to 5.5%)

- SAVING ON PURCHASE COSTS

- $28,391

Total Project Economics

Get your FREE 15-minute strategy session now

Why be a passive property investor (buy, pray and hold strategy) when you become an active property investor (buy, manufacture equity, uplift equity and hold strategy)? Let me show you my proven strategies to turbo boost your property portfolio, create wealth and take steps towards your financial freedom.

Book your strategy session