How I secured a highly valuable subdivision project with rapid analysis and by acting fast

The property on 974 sqm block with a post war weatherboard house came on the market on 8 May 2015 (Friday). I saw the listing on Saturday morning when preparing for a weekend getaway on the Gold Coast. Feeling excited, I did my due diligence and feasibility analysis, and made an cash and unconditional offer by midday. Although my offer was not the highest in price, the vendor, who was going into a home, accepted my offer due to no condition.

There is no perfect property to subdivide. Besides short of the 1,000 sqm for battleaxe subdivision, 9 Laurie St had the challenges of overland flow and a relatively steep backyard. My town planner still gave a thumbs up for the subdivision because the next door neighbour, who has completed the subdivision and built a new house on the rear lot, had set a precedent. Moreover Westfield Cardinale is only 380 m walking distance away.

By lunchtime on Monday, my town planner, surveyor, civil engineer and hydraulic engineer had provided their respective preliminary assessment and confirmed its subdivision potential. I had a subdivision project!

My strategy to manufacture equity is to subdivide 1 lot into 2 lots, retain the existing post in front and build a house on rear lot, and keep them long term. New or newish houses are in much higher demand than older-styled houses in the same area. Buyers will pay a premium to buy and tenants will pay a premium to rent the new or newish houses. If I were to play developer and sell the subdivided land or new house, I would lose the opportunity to good asset that I created to appreciate in value and rent over time.

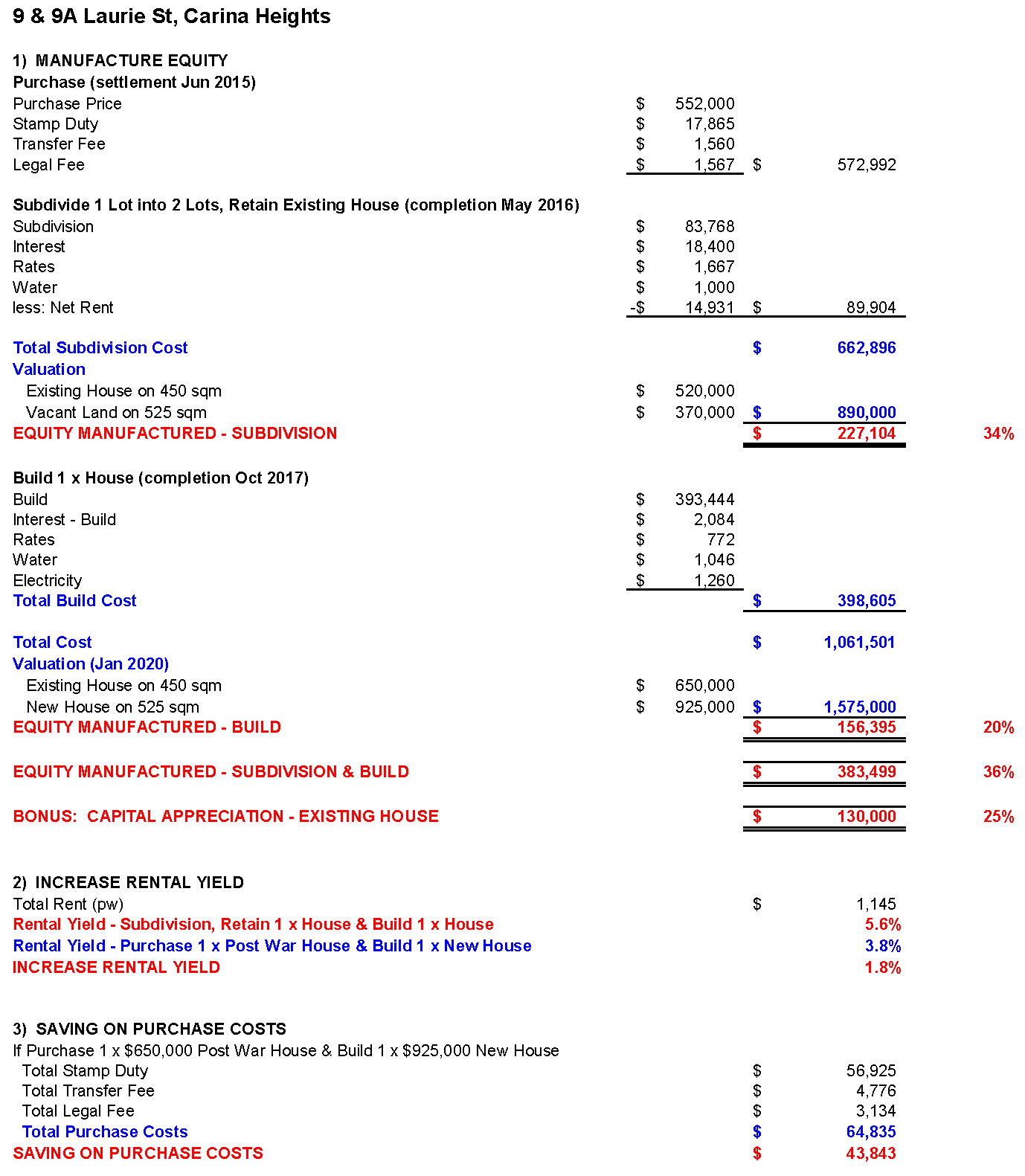

The subdivision project went relatively smoothly. The vacant block at the rear was valued at $370,000 and the existing house at $520,000 11 months later (May 2016). Hence I manufactured $227,104 or 34% in equity and I still had a full time job! I refinanced the vacant lot and uplifted $108,000 in equity, which was used to fund the next project, i.e. build a house on the rear lot.

In fact I had started the build project 3 months before the subdivision was completed. To ensure a successful build project, you have to build the right house for the block and area, i.e. not to over or under capitalise on the land.

There is no perfect block to build on. 9A Laurie St, i.e. the rear lot, slopes up and has overland flow in front section. However once the new house is built, it is a beautiful home. No one will talk about it being steep or has overland flow. Essentially I eliminated the shortcomings of the block by build a new house on it.

The $40,000 worth retaining walls did give me some grief. After the builder cut the building pad, we put a pause to the construction in order for my contractor to build the retaining walls, which required building approval as they were over 1 m in height. The as constructed survey showed that 3 sections of the retaining wall were over the boundary by 6.5 cm to 10 cm! Instead of rectifying the retaining walls and further delay the house construction, I negotiated with the contractor to share the cost for the new civil engineer report and new building approval. Lesson learnt, make sure you engage the appropriate contractor and build the retaining wall well within your property.

Apart from that, the build project went according to plan. The new house was valued at $925,000 in Jan 2020. Hence I manufactured $156,395 or 20% in equity. In an ideal world, I would go back to the bank to refinance the house and uplifted $148,000 in equity, which would be used to fund my next purchase or project. However the APRA's responsible lending guidelines stop me from doing that.

The successful subdivision and build projects also increased the rental yield by 1.8%, i.e. I achieved a higher 5.6% rental yield compared to 3.8% if I were to buy 1 older styled house at $650,000 and 1 new house at $925,000. In addition, I had a $43,843 saving in purchase costs.

Having said that, the PRIZE for subdivision and build projects is EQUITY MANUNFACTURED, which enables you to buy your next property or do the next project, create wealth and take steps closer to your financial freedom.

- EQUITY MANUFACTURED - SUBDIVISION

- $227,104 (34%)

- EQUITY MANUFACTURED - BUILD

- $156,395 (20%)

- EQUITY MANUFACTURED - SUBDIVISION & BUILD

- $383,499 (36%)

- INCREASE RENTAL YIELD

- 1.8% (to 5.6%)

- SAVING ON PURCHASE COSTS

- $43,843

Total Project Economics

Get your FREE 15-minute strategy session now

Why be a passive property investor (buy, pray and hold strategy) when you become an active property investor (buy, manufacture equity, uplift equity and hold strategy)? Let me show you my proven strategies to turbo boost your property portfolio, create wealth and take steps towards your financial freedom.

Book your strategy session